Probably we can make a statement that today’s most lucrative market belongs to chip production, and one of the coolest CEOs is NVIDIA’s Jensen Huang, who every time talks about the growth of their industry with great passion.

The developments of the past 5 years in particular pushed the demand for chips to a new level, and we are at a point where some companies even face shortages. And as we become more and more dependent on generative AI technologies, and different types of software (from productivity to music) used daily, every delay may impact the regular end users instantly. Let’s see how the chip market is evolving and what price changes are influencing different industries that rely on fast and well-engineered chips.

How Live Casinos and Gaming Sites Are Adapting to Rising Chip Costs

As we analyzed different industries, one trend popped out in the research, and it was the increase of the demand for live experiences on digital platforms. Many of them deliver live interactions, which includes streaming real dealers or multiplayer games requiring robust computing and graphics hardware for smooth, low-latency video feeds and instant responsiveness. Keep in mind that all this infrastructure relies on advanced chips (GPUs, FPGAs, etc.) to encode video, run game logic, and manage thousands of concurrent users in real time.

In fact, live casino online platforms increasingly employ machine learning to analyze player behavior and tailor recommendations on the fly. This boosts engagement and keeps customers satisfied. AI is also applied to assist human dealers and moderators: for example, algorithms monitor live gameplay to immediately flag any irregularities or potential fraud, helping ensure fairness. These capabilities give players more confidence and a more customized experience, but they demand significant computing power. Each real-time AI feature, from detecting a card on a video feed to generating personalized game suggestions, adds to the load on the platform’s servers, further increasing the need for high-performance chips.

The challenge is that AI-optimized chips have become very expensive, and their prices keep rising. For instance, Nvidia’s H100 data-center GPU (a popular choice for AI tasks) is priced around $30,000–$40,000 per unit amid sky-high demand. Live gaming companies are adapting to these rising chip costs in pragmatic ways. Some are optimizing their software to do more with fewer resources or leveraging cloud computing (renting GPU power on demand instead of buying hardware upfront). Others form partnerships or long-term contracts to secure chip supply. Despite the cost pressures, live casino and gaming sites recognize that investing in the latest chips is essential. Real-time user experiences are their lifeblood, so they allocate budgets accordingly, ensuring they have the necessary GPU/AI horsepower to deliver smooth gameplay and interactive features even as hardware prices climb.

AI Chip Prices: Five-Year Growth Trend

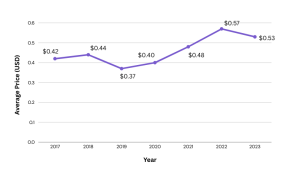

The past 5–7 years have seen a dramatic rise in average chip prices, reversing a long trend of declining cost per transistor. The chart below illustrates the year-by-year increase in the average selling price of a semiconductor chip (across all types) since around 2017, based on industry data and reports.

Global average selling price of semiconductor (2017-2023).

Several factors drove this price growth. One is the explosion of generative AI and machine learning applications. As AI models became more prevalent (from cloud data centers to edge devices), demand soared for the specialized processors needed to train and run these models. Tech giants and start-ups rushed to acquire GPUs and AI accelerators, tightening supply and pushing up prices. At the same time, pandemic-era supply chain disruptions led to chip shortages in 2020–2021, creating a bidding war for available semiconductor stock.

Better User Experience Means More Investment in Technology

Across the digital landscape, from online casinos to productivity apps, user expectations have never been higher. Modern users demand snappy, intelligent, and reliable services. Industry leaders like Google, Amazon, and Facebook have set a high bar, training consumers to expect seamless and responsive experiences everywhere.

Since we already talked about the digital casino landscape it is not a surprise that many online casinos even turn to their customers asking what are the new features they would like to see in a slot game for example and this means that these platforms are ready to implement new features and become more sophisticated if this is what their customers desire.

View this post on Instagram

This mindset of user-driven innovation illustrates why companies pour resources into advanced tech. If players indicate they want richer graphics, more interactive gameplay, or AI-driven personalized content, the platform operators are prepared to make it happen – which often entails upgrading their hardware to more powerful, specialized chipsets. The same goes for other sectors: for instance, office software users now expect smart suggestions (powered by AI) and real-time cloud syncing, and developers respond by integrating AI models into their apps, which in turn demands beefier processing in the cloud.

To deliver these capabilities, organizations are investing in state-of-the-art chips and AI accelerators. Many tech companies have even started designing custom chips in-house to meet their unique performance needs. Google, Apple, Amazon, and others build proprietary AI processors (like TPUs or neural engines) so that they can optimize speed and efficiency for their services – from search algorithms to voice assistants – without relying solely on third-party chip vendors. Likewise, cloud providers and enterprise platforms are allocating billions of dollars to upgrade their data centers with the latest AI hardware. All of this is driven by the understanding that cutting-edge hardware translates into cutting-edge user experiences.